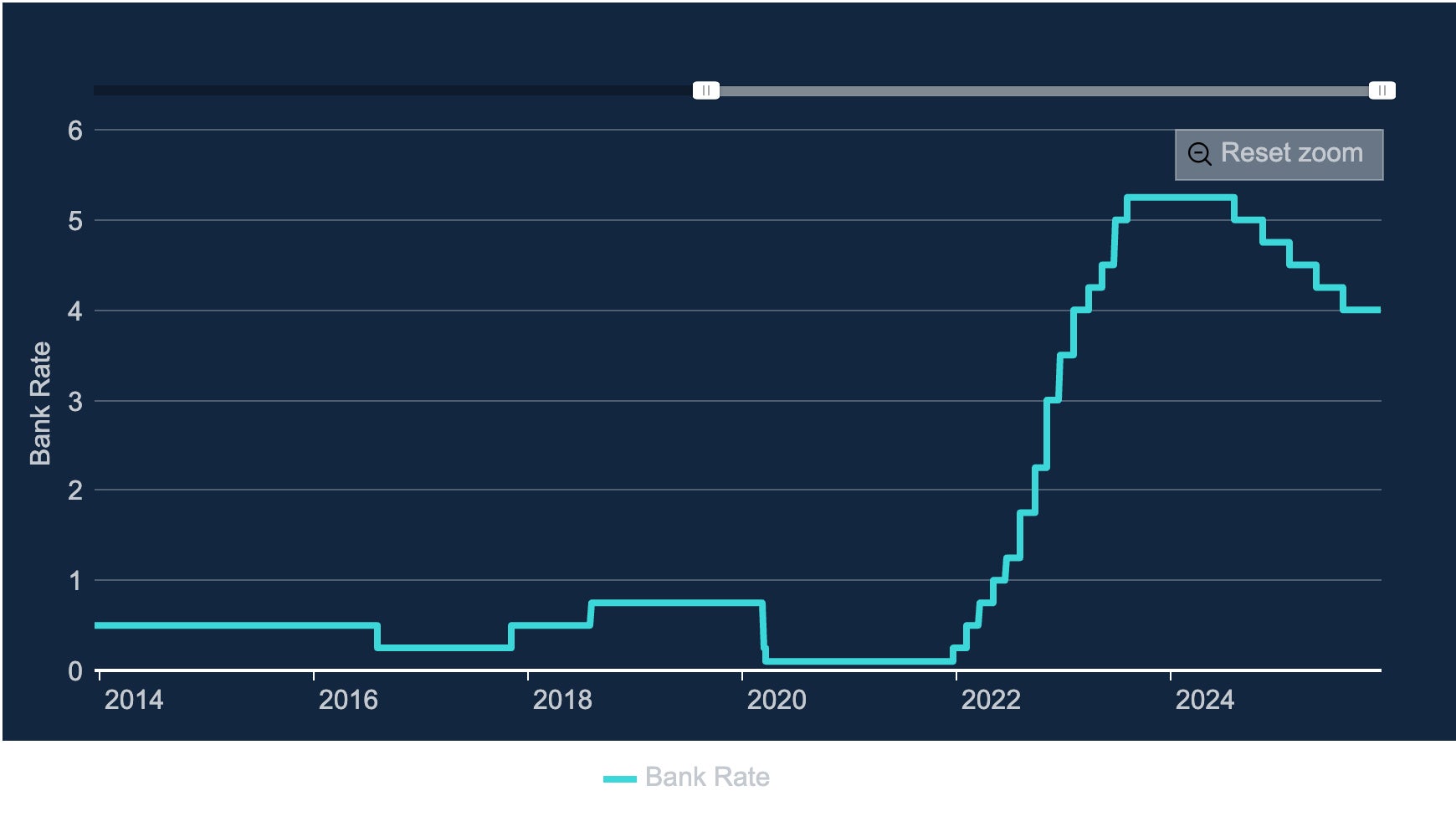

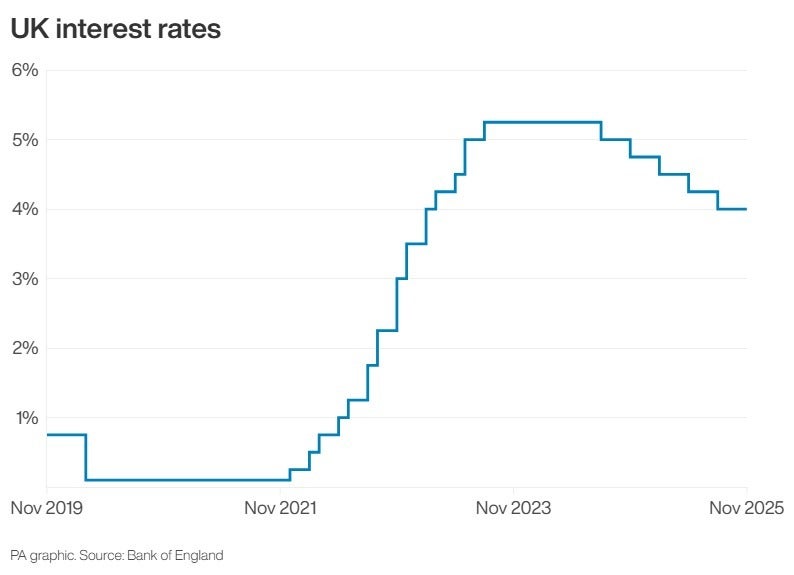

The Bank of England is widely expected to cut its interest rates on Thursday, a move anticipated following a significant drop in inflation to an eight-month low of 3.2 percent in November. This potential reduction would mark the fourth rate cut this year, bringing the base rate from 4 percent to an estimated 3.75 percent, the lowest it has been since early February 2023. The cooling inflation is largely attributed to decreased food and drink price increases, as well as easing alcohol and tobacco prices.

Economists believe a rate cut is highly probable due to a confluence of recent economic data. This includes a 0.1 percent contraction in the UK economy in October, rising unemployment, slowing wage growth, and the unexpectedly low inflation figure. While the Bank of England has been cautious about cutting rates due to persistent inflation, the latest data suggests price pressures are rapidly easing.

Despite the positive news for borrowers, inflation remains above the Bank of England's 2 percent target. Analysts suggest that the Bank may need to act more decisively in 2026 if inflation continues to fall towards the target, with some economists warning of a risk that the Bank could "fall behind the curve." The market anticipates potential further cuts in 2026, though the exact pace remains uncertain, and borrowers are advised to prepare for a return to ultra-low rates to be gradual.